POS (Point Of Sale) Setup

Setup Steps

Organization – Address

One of the first steps in setting up CBOS to process point of sale transactions for a given organization is to add or update the Organization address information.

Since POS Terminals may be located in different tax jurisdictions, a specific tax rate may need to be created for each respective location and associated to the POS Terminal in that jurisdiction.

The State entered on the address field in the Organization Info tab must match the Region (from) value for every tax rate to be associated with a POS Terminal in that respective Organization. In this example, the Organization is assigned an address in the state of Virginia (VA).

Menu Path: SYSTEM MENU: Organization (Maintain Organization) > Organization Info

Tax Rates – Region From

The tax rates associated with POS Terminals are assigned to that terminal based upon the Organization State (Region) and the POS Terminal default Business Partner location.

In this example, Tax Rates for the Organizations multiple POS Terminals are assigned to the Virginia (VA) from Region. (More tax rate setup information is covered later in this guide.)

Menu Path: SYSTEM MENU: Tax Rates

Organization – Point of Sale Configuration

One of the first steps in setting up CentralBOS to process point of sale transactions for a given organization is to add or update the POS Configuration information.

Menu Path: SYSTEM MENU: Organization (Maintain Organization) > POS Configuration

Select ![]() to add POS Configuration information.

to add POS Configuration information.

POS Configuration

Select More Options > Edit for a highlighted row for review & update

This window allows you to review and update detailed information related to the selected configuration.

Key Fields:

|

Name |

Description |

|

Admin Roles |

Set the Admin role(s) value of the organization. Enter semi-colon ";" separated Role Record IDs. Once configured, only users having admin role access can delete POS tickets. If Discount Restricted is enabled (Y) just Admin Roles can perform discounts on SmartPOS. |

|

Default Business Partner |

Set the business partner that will be selected by default in the POS terminal(s) within the organization. |

|

Discount Charge |

Select the charge code / account for the discounts applied. |

|

Deposit Charge |

Select the charge code / account in case of deposit bank transfer. |

|

Charge Tips |

Select the charge code / account for Charge Tips. |

|

Currency |

Set the default currency value. |

|

Payment Term |

Set the default payment term for POS orders. |

|

Tax Rate For POS |

Default tax rate for POS (not in use). |

|

Partner Location |

Default location for the selected default business partner. |

|

Price List Version |

Set the default price list version; Informational only. Uses the customer price list if available and if not, uses the associated warehouse price list. Will display message if no default pricing is found. |

|

List Product Category |

The field name actually refers to the product types. (A=Asset, R=Resource, I=Item, etc.) If the product type is not referenced in this field, the User will encounter an error when attempting to add products of that product type to POS Tickets. |

|

Warehouse |

Default warehouse (not in use) |

|

Check Open Orders Time |

Delay time for open orders in milliseconds. |

|

Check Orders Time |

Delay time to check orders time. |

|

Decimals |

Set the decimal point. |

|

Size Image |

Set the default size of the image. |

|

Locale |

Set the default locale. |

|

List Payment Term |

Set the available payment term Record ID’s. |

|

Printers by Group |

Set the default printer group. |

|

Printing from client |

Check if printing from the client. |

|

Discount Restricted |

Check if discount needs to be restricted. If enabled (Y) indicates that just admin roles can perform discounts on SmartPOS. |

|

POS Tax |

Check if POS tax needs to be enable (not in use). |

|

Send Mandatory |

Check if Send ticket needs to be mandatory. |

|

Terminal Assigned to Logged in Warehouse only |

If the flag is checked: A User may only access POS Terminals if they have the same warehouse assigned to them as the one logged in from the main login. (Others will not display from the dropdown Terminal selection in the SmartPOS). If left unchecked, default system behavior will occur, and all Terminals will appear from the dropdown regardless of the warehouse currently logged into. This flag must be selected in order to process "SmartPOS Sales Returns". Otherwise the Terminal selection field will not display any values. |

Warehouse – is POS

Specific warehouses must be point of sale enabled by selecting the Is POS checkbox.

Menu Path: SEARCH MENU: Warehouse (Maintain Warehouse & Locators)

Select More Options > Edit for a highlighted row for review & update

Key Fields:

|

Name |

Description |

|

Is POS |

Must be checked |

|

Price List |

Must select one of the Price list; used if POS customer does not have a price list assigned. |

|

Price list version |

Must select one of the Price list version. |

|

Role |

Need to select "Client Admin" or "Accounting Admin" or who ever has rights to perform accounting operation. |

|

Document Type |

Must be "AR Invoice (SmartPOS)". |

|

Bank |

POS Terminal setup is used for assigning the bank and bank account for payments associated with invoices generated from a specific POS Terminal. |

|

Bank Account |

POS Terminal setup is used for assigning the bank and bank account for payments associated with invoices generated from a specific POS Terminal. |

Select the Locator tabbed window to set a location as the default for this warehouse.

Menu Path: SEARCH MENU: Warehouse (Maintain Warehouse & Locators) > Locator

Key Fields:

|

Name |

Description |

|

Default |

Must be checked |

|

Active checkbox |

Must be checked |

Business Partner – Sales Rep

Business Partners who are designated as sales reps may have a discount limit specified. The discount limit will be enforced when processing POS transactions.

Menu Path: SYSTEM MENU: Business Partner (Maintain Business Partners) > Discount Limit tab

Key Fields:

|

Name |

Description |

|

Discount Limit % |

Enter discount limit percentage if applicable. |

|

Effective From |

Discount will be applicable only for the defined date range. |

|

Effective To |

Discount will be applicable only for the defined date range. |

|

Active |

Discount functionality would be applicable only if its checked. Even though all details specified the discount will not be available for the sales rep. |

Users

Users must link back to a Business Partner and have an email / password assigned. They must also be assigned a role.

Menu Path: SYSTEM MENU: Users (Maintain Users of the System)

Key Fields:

|

Name |

Description |

|

Business Partner |

Sales Rep association |

|

Email Address |

Sales Rep Login ID |

|

Password |

Sales Rep Login Passwords |

|

Active Checkbox |

Must be checked |

Select the User Roles tab to assign a role to this user.

Menu Path: SYSTEM MENU: Users (Maintain Users of the System) > User Roles tab

|

Name |

Description |

|

Role |

Sales rep must have required role to perform accounting actions for POS. Roles such as "Client Admin", "Accounting Admin". |

Log in as a POS User

Select Org and Warehouse for POS transactions. The organization must be setup for POS transactions and the warehouse must be enabled for POS transactions. The user must be a business partner, sales rep, and setup with an appropriate role. Only POS Terminals associated with the log in Warehouse will be selectable for POS transactions. The user must also be assigned to the POS Terminal to enter orders in there.

Bank Accounts/Credit Cards

The bank account and credit card account are assigned to each respective POS Terminal that is setup.

Menu Path: Financials > Financial Data > Bank Accounts/Credit Cards

Bank Accounts/Credit Cards > Grid View

This tab defines a bank that is used by an organization or business partner. Each bank is given an identifying Name, Address, Routing No and Swift Code. Bank and credit card information may be added and updated in this window.

Bank Accounts/Credit Cards > Edit

Field Definitions:

|

Name |

Description |

|

Organization |

An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. |

|

Name |

The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. |

|

Description |

A description is limited to 255 characters. |

|

Active |

There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. |

|

Address |

The Location / Address field defines the location of an entity. |

|

Own Bank |

The Own Bank field indicates if this bank is for this Organization as opposed to a Bank for a Business Partner. |

|

Routing No |

The Bank Routing Number (ABA Number) identifies a legal Bank. It is used in routing checks and electronic transactions. |

|

Swift code |

The Swift Code (Society of Worldwide Interbank Financial Telecommunications) or BIC (Bank Identifier Code) is an identifier of a Bank. The first 4 characters are the bank code, followed by the 2 character country code, the two character location code and optional 3 character branch code. For details see http://www.swift.com/biconline/index.cfm |

Account Tab > Grid View

The Account Tab is used to define one or more accounts for a Bank. Each account has a unique Account No and Currency.

"POS Terminals" are assigned a bank account and specific cash account within that bank.

Account Tab > Edit

|

Name |

Description |

|

Organization |

An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. |

|

Account ID |

A search key allows you a fast method of finding a particular record. If you leave the search key empty, the system automatically creates a numeric number. |

|

Account Name |

The name of an entity (record) is used as a default search option in addition to the search key. The name is up to 60 characters in length. |

|

Bank |

The Bank is a unique identifier of a Bank for this Organization or for a Business Partner with whom this Organization transacts. |

|

Account No |

The Account Number indicates the Number assigned to this bank account.

|

|

BBAN |

The Basic (or Domestic) Bank Account Number is used in Bank transfers (see also IBAN). For details see ISO 13616 and http://www.ecbs.org/. |

|

IBAN |

If your bank provides an International Bank Account Number, enter it here. The account number has the maximum length of 22 characters (without spaces). The IBAN is often printed with a space after 4 characters. Do not enter the spaces. |

|

Description |

A description is limited to 255 characters. |

|

Active |

There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports. |

|

Default |

The Default Checkbox indicates if this record will be used as a default value. |

|

Currency |

Indicates the Currency to be used when processing or reporting on this record. |

|

Bank Account Type |

The Bank Account Type field indicates the type of account (savings, checking, card, or cash) this account is defined as. For POS use assign the type as "Cash". |

|

Credit limit |

The Credit Limit field indicates the credit limit for this account. |

|

Payment Export Class |

null |

|

Current balance |

The Current Balance field indicates the current balance in this account. |

POS Terminal

The point of sale terminal will be used to record sales transactions. The POS terminal is associated with an organization and warehouse.

Menu Path: SEARCH MENU: POS Terminal (Maintain Your Point of Sale Terminal)

Key Fields:

|

Name |

Description |

|

Organization |

Must be selected for which POS configuration done in above steps. |

|

Active Checkbox |

Must be checked |

|

Bank Account |

Bank account which is assigned to this POS Terminal; used for creating payments associated with invoices generated from sales at this terminal. |

|

Cash Account |

Select "Cash" account as added in above steps ( all cash accounts will be displayed in the dropdown); used for creating payments associated with invoices generated from sales at this terminal. |

|

Price List |

Required field; Informational only |

|

Warehouse |

Select from dropdown for which POS configuration needs to be done. Used for finding a price list when POS customer is not assigned a price list. |

|

Use POS Location for Tax |

If checked, the Default Business Partner location will be used to determine the "To" region (State) for Tax Rate assignment. |

|

Default Business Partner |

Used to find the "Ship To" location for tax rate assignment; the default business partner will have a location address the same as the POS Terminal; the tax rate will be determined by the POS terminal location. |

Select the User tab to link the sales rep to the terminal

Menu Path: SEARCH MENU: POS Terminal > User

Only these Users/Sales Reps will be able to access this POS terminal which has been defined here. Multiple Users/Sales Rep can be assigned for 1 terminal.

Key Fields:

|

Name |

Description |

|

User/Contact |

Select the Sales Rep User to assign the terminal. |

|

Active Checkbox |

Must be checked |

Products – POS Settings

The product POS Settings window allows the user to specify if discounts are allowed for a given product and if you "buy one you get one free".

Key Fields:

|

Name |

Description |

|

Discount Allowed |

Discount field will get enabled at POS ticket for the product only if this checkbox is checked. |

|

Buy One Get One Free |

If this checkbox is checked then at POS ticket > user have to enter product qty in odd numbers only and price would be calculated for half of the qty. Ex. Product price 10 and qty added 4: Actual total = 40 but as Buy 1 get 1 checkbox checked: Total = 20. |

POS Tender Type

The POS tender type is referenced on POS transactions and may include cash, credit card, and checks. Tender types are defined at client level. Tender type can be specified in System Configurator window as below.

Tender types supported by POS may include "cash", "check", and "credit card".

Menu Path: SEARCH MENU: POS Tender Type

Key Fields:

|

Name |

Description |

|

Search Key |

Cash, check, or credit card. |

|

Name |

Descriptive |

|

Tender Type |

Cash, check, or credit card. |

|

Active |

Must be selected to be used. |

POS - Sales Tax

The POS application can be setup to calculate sales taxes based upon the specific location of the POS terminal or the actual customers ship to location referenced on respective sales orders created at that terminal. This determination is based upon the "Use POS Location for Tax" setting in the POS Terminal window.

POS Terminal Settings

If "Use POS Location for Tax" is checked, the system will use the location of the Default Business Partner, also assigned to the POS Terminal to determine the sales tax rate to use. If not checked, it will use the customer assigned to the POS order to determine the sales tax rate to use.

Each POS Terminal must have a Default Business Partner assigned to it. "Use POS Location for Tax" will be checked by default and it is a non-updateable field.

Menu Path: SEARCH MENU: POS Terminal

Default Business Partner Setup

In order to implement this feature, default business partner (customer) records will need to be created with their location record having the physical address of the POS Terminal they will be assigned to. In the example below, the customer location record will have the physical address of the Alexandria, VA POS Terminal it will be assigned to.

Menu Path: Sales > Sales Data > Customers

Customer

Customer > Location

The tax will be calculated on the basis of location of Default Business Partner associated to respective POS Terminal.

POS Tax Rates

Tax rates needs to be defined in Tax Rate window such that location specific tax will always have ‘Region From’ same as that of Organization's Region. ‘Region To’ value will be the state for which the POS Terminal tax needs to be calculated.

For example, The Tax "BLK VA" will have "Region From" value as "VA" (as the Organization region is VA) and "Region To" value as "VA" (since the POS Terminal is located in Virginia). Make sure that the "Parent Tax" is empty for taxes.

The tax will be calculated on the basis of the location of the Default Business Partner associated to respective POS Terminal.

Menu Path: SEARCH MENU: Tax Rates

POS Tax Rates – for non-taxable items

You will need to create separate location specific taxes as explained above for Non-Taxable products with tax rate as 0. These tax rates will be assigned a Tax Category of "No Sales Tax", which can be assigned to non-taxable products.

After doing the configuration explained above, taxes will be calculated as follows:

- The tax will be calculated on the basis of:

- Region From - The tax rates associated with POS Terminals are assigned to that terminal based upon the Organization Region (State)

- Region To - The location of the Default Business Partner associated to a respective POS Terminal

Similarly, for the No Sales Tax products, the No Sales Tax defined for that particular location will be applied.

If the POS terminal does not have Default Business Partner defined then it will show an error message saying "Please configure Business Partner in POS Terminal window".

SmartPOS will give a "No Tax Found" error if:

- The Tax Rate is not defined

- The "Region From" location in Tax Rate window is not the same as Organization region

- The "Zip From" in Zip tab of Tax Rate window is not the same as Organization zip code

The Tax Exempt checkbox on the SmartPOS window will exempt all taxes on the ticket.

The total applied tax on the products will be visible at the bottom right corner of SmartPOS window. Products specific tax rates will not be displayed.

Smart POS Document Type

The Smart POS document type is assigned to sales orders created through the Smart POS window. The ‘Smart POS’ document type should be configured as follows.

Menu Path: SEARCH MENU: Document Type

Key Fields:

|

Name |

Description |

|

Name |

Smart POS |

|

Sales Transaction |

Selected (check marked) |

|

Document Base Type |

Sales Order |

|

SO Sub Type |

Leave blank |

|

Document Type for Invoice |

AR Invoice (SmartPOS) |

|

Document Type for Shipment |

MM Shipment Indirect |

|

Print Format |

Custom SmartPOS Header (configurable) |

POS Key Layout

Not currently used in the system.

Menu Path: SEARCH MENU: POS Key Layout

POS Payment

Not currently used in the system.

Menu Path: SEARCH MENU: POS Payment

POS (point of sale) Transactions

Processing Steps

Smart POS

The Smart POS application can be used to enter and process customer sales and payment transactions.

Menu Path: Sales > Transactions > Smart POS

This brings you to the "landing page", which allows you to select which Terminal to enter (if you have access to more than one), and to view any open tickets that remain within that Terminal.

In order to work on open tickets, highlight the one you would like and click Select at the bottom of the page. This then takes you to the detail screen of that ticket. Here you can finish the ticket, add or delete items within the ticket, or delete the entire ticket.

From the "landing page" you can also click New in order to start a new ticket or just double click anywhere on the terminal and it will create new ticket.

Fill in the Customer information (you can either type in the name of the customer or click the green circle to do a system search) and Sales Date (will default to today).

By default, the customer will be populated which is set as "Default Business Partner" in Organization > POS configuration window.

Next, click into the Product field. Here you can either type in the name of the product, click on the green circle to do a system search, or use a scanner to scan the product into the field.

Once you have the product entered, select Enter on your keyboard to move the product into the detail line. If you are scanning the product will automatically move to the detail line as you scan.

To change Quantity, manually type in the number in the QTY column, highlight the product and click on the![]() icon or continue to scan the same item to increase the QTY.

icon or continue to scan the same item to increase the QTY.

If at any time, you wish to delete a line of product highlight the product line and click Delete Product.

Product default pricing is based upon:

- The Customer assigned price list if available and assuming product is assigned to it

- If no customer price list for product, then look for price list assigned to the Warehouse associated with the POS terminal

- If product is not referenced on either price list, then a message will display that no default pricing is available

If at any time, you wish to delete the entire ticket, simply click Delete Ticket. Delete capability is controlled with the Organization > POS Configuration admin setting covered previously.

If you just want to go back and create new ticket without doing further action like payment then click on Close POS button > user is redirected to POS Terminal where this ticket would be displayed in the list.

Taxes will be calculated as follows:

- The tax will be calculated on the basis of location of Default Business Partner associated to respective POS Terminal

- Similarly, for the No Sales Tax products, the No Sales Tax defined for that particular location will be applied

- If the POS terminal does not have Default Business Partner defined then it will show an error message saying "Please configure Business Partner in POS Terminal window"

- SmartPOS will give No Tax Found error if:

- Tax Rate is not defined

- The "Region From" location in Tax Rate window is not the same as Organization region

- The Tax Exempt checkbox on the SmartPOS window will exempt all taxes on the ticket

- The total applied tax on the products will be visible at the bottom right corner of SmartPOS window. Products specific tax rates will not be displayed

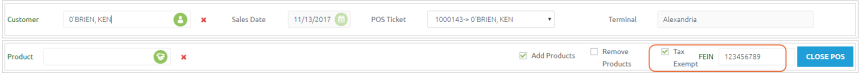

To mark this ticket as Tax Exempt, place a checkmark in the Tax Exempt field and then enter the FEIN number.

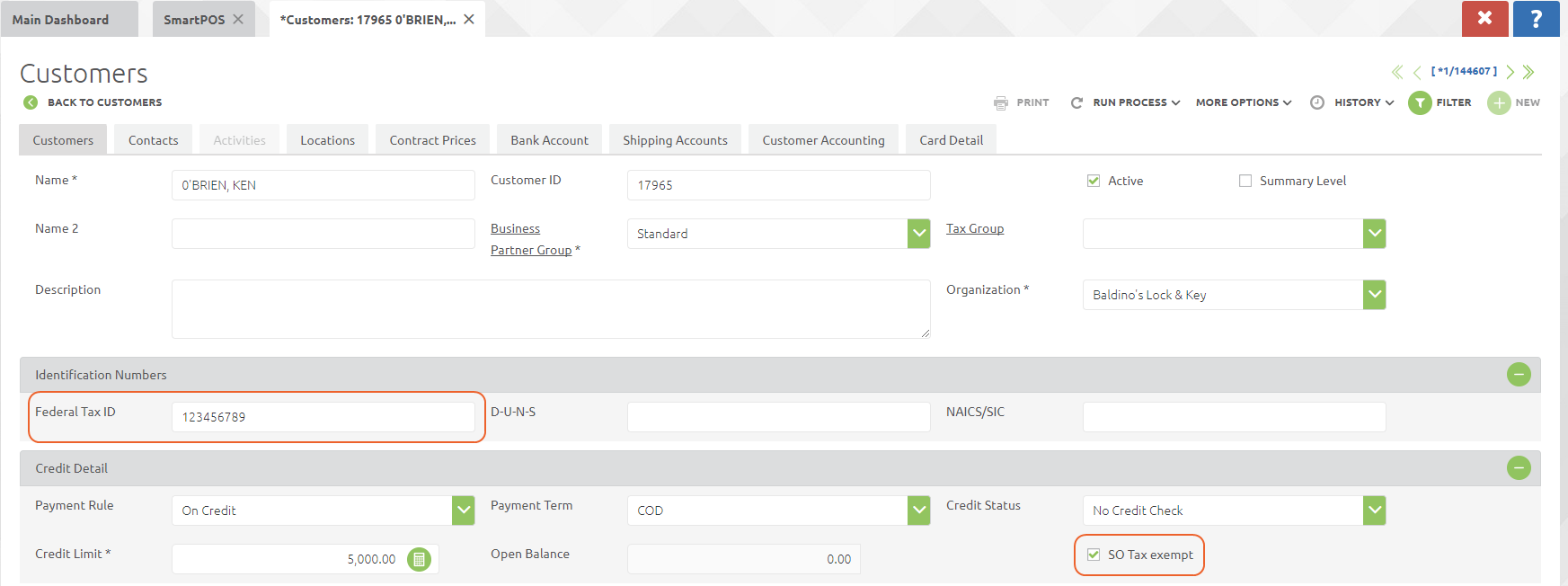

Menu Path: Sales > Sales Data > Customers

Select the SO Tax Exempt check box and provide value for the Federal Tax ID

Whenever this customer selected on POS ticket – Tax Exempt check box will be auto checked and FEIN number also auto populated as per filled in customer details.

To apply a line level discount, highlight the product line, click Discounts and enter the "dollar amount" or "% being discounted". If percentage is not checked, the value is considered dollars.

The discount button availability is controlled in the organization "POS Configuration".

Or if the discounts button is not displayed, just enter the discount value as a dollar amount or select the percentage check box in the detail product line to enter the amount as a percentage.

Validation is applied that Sales rep cannot exceed its limit for applying the discount specified at Business Partner level.

Payment Processing

When ready to accept payment, click Pay.

This opens up the payment screen, where you can put in the Tender Type and Amount Received. Tender types may include cash, check, and credit card.

When ready, click Add Payment.

Once you click Add Payment, the system will let you know how much change to give (If cash was chosen as the tender type).

If tender type of Check is chosen, the system will open up fields to put in the check information.

Key Fields:

|

Name |

Description |

|

Check No |

Required: Assigns entered value as Payment No on Payment record |

|

ID# |

Required: Assigns entered value as Check Id# on Payment record |

|

Other Check Related Fields |

Optional: Information is not required |

If tender type of Credit Card is chosen the appropriate fields will display as well.

Key Fields:

|

Name |

Description |

|

Credit Card Type |

Required: displays on Invoice and Payment record |

|

Authorization Code |

Required: displays on Receipt and Payment record |

When the transaction is complete, click OK.

Multiple tender type payments in 1 ticket are allowed. In this example, both cash and credit card payment were accepted for a single ticket.

Receipt Printing

Once OK is clicked, the "Receipt" for printing will appear. Click the printer icon in the upper right corner to print the receipt.

When you click back on the SmartPOS tab at the top, you will now be back at the "Landing Page" to click New for another transaction.

Credit card receipts will print the Authorization Code entered in the Payment window, as shown below:

Receipt Emailing

Select the envelope icon in the light gray tool bar to email the receipt.

This will pop-up the Send Mail window shown below. The receipt will be attached as a pdf file and notes may be added to the email body. Additional documents may be attached to the email by selecting the paper clip icon in the lower gray bar.

The To and Email fields will display the customers’ default contact if one exists, otherwise you may manually enter a name and email address. This email process applies to all documents within CBOS.

Other Transactions

Cash Movements

The Cash Movement application can be used to enter and process transactions moving cash from one terminal to another and for adjustments to a closed cash end of day report.

Menu Path: Sales > Point of Sale > Transactions > Cash Movements

This brings you to the cash movement screen, which allows you to select the terminal, movement type (in or out), and dollar amount that you are moving in or out of the selected terminal.

Cash In:

Cash Out:

Select Process to complete your transaction.

Adjustments

Adjustment entries to the End of Day Close Cash can be made using the Cash Movements window and selecting the Adjustment check box.

Then select the Close Cash end of day to associate the adjustment with.

The End of Day Report End of Day Report Line tab displays the adjustment to close cash:

Sales Returns

The Sales Returns application can be used to enter and process transactions for goods and services being returned from a customer.

Menu Path: Sales > Point of Sale > Transactions > SmartPOS Sales Returns

This brings you to the sales returns screen where you can either enter or search for the invoice you wish to process a return against.

First, select the Terminal that you wish to process the return against. The terminal selection list includes terminals associated with your logged in warehouse and the POS Terminal user assignment.

If you know the Invoice number, just enter it and tab or click out of the Invoice field to display the information associated with that invoice.

To search for an invoice number, select the green icon in the invoice field and a new search window will display. Enter one or more criteria to narrow your search if you wish and then select the search button.

Select the invoice document number and click the OK button to continue processing the return.

On this window, the Business Partner, Date, Warehouse, and Refund Amount values default and are read only. The Refund Amount may be recalculated based upon the quantity to be returned being changed.

You must select the RMA Type and optionally check the Affects Inventory box to determine whether you want to return the item(s) to inventory or just create an AR Credit Memo.

The Tender Type value defaults to either cash or credit card based upon the selected invoices original payment method. The value does not default for selected invoices having an original payment method of check. Typically, the user would select cash as the tender type for these types of refunds. The Credit Card Type also defaults based upon the original invoices card type.

If the Tender Type is "Credit Card", then the Authorization Code value must be entered for the return transaction.

After selecting one or more-line items to return to stock, you will have the ability to update the return quantity for each line.

Select the Process button to create the return transactions.

The process creates an Invoice having Document Type as "AR Credit Memo" and opens up the Invoice window for review. The AR Credit Memo will reference the return tender type (cash or credit card) as its payment rule as well as the credit card type when applicable.

It also creates a negativeCustomer Payment record and allocates the AR Credit Memo to it. The customer payment record includes the tender type and credit card type with authorization code for credit card returns.

A Customer RMA record is also created by the return process to facilitate the creation of the AR Credit Memo and the optional Product Return.

If "Affects Inventory" is selected, it also creates an RMA Product return record. This record is used to facilitate the inventory movement back to stock for the return goods.

End of Day Close

The End of Day Close application can be used to close out and reconcile cash transactions for a specified terminal.

Menu Path: Sales > Point of Sale > Transactions > End of Day Close

This brings you to the end of day close screen where you can select the terminal to close out.

The end day date defaults to the current date & time, and the start day date defaults to last date/ time that the selected Terminal was last closed.

The user must be logged in to the "Warehouse" associated with the terminal and have "Shop Manager role" access to complete the "End of Day" process for the selected terminal.

Initial window display after Terminal has been selected:

Users may then enter the Actual Cash On-Hand and Actual Checks On-Hand for the selected Terminal and the system will calculate the "Over / (Short)" amount and the "Closing Cash Balance" amount. The terminal can be closed out with over / short amounts existing.

If the actual entered cash on hand varies from the calculated amount an informational message will display.

Window display after Actual Cash On-Hand and Actual Checks On-Hand have been entered:

Window display after Closing Cash Balance and Closing Checks Balance have been updated:

Select the Close Cash button to process End of Day Close and the End of Day Report window will automatically open and the End of Day Close window field values will be updated.

End of Day Report:

Key Fields:

|

Name |

Description |

|

Opening Cash Balance |

From prior closing cash balance. |

|

Opening Check Balance |

From prior closing check balance. |

|

Note: For sum and number fields below include transactions created between the last close cash & current close cash fields below.

|

|

|

Cash Sales |

Sum of all cash tender type payments. |

|

Cash Tickets |

Number of all cash tender type payments. |

|

Credit Card Sales |

Sum of all credit card tender type payments. |

|

Credit Card Tickets |

Number of all credit card tender type payments. |

|

Check Sales |

Sum of all check tender type payments. |

|

Check Tickets |

Number of all check tender type payments. |

|

Total Sales |

Calculated: Cash Sales + Credit Card Sales + Check Sales |

|

Cash In |

Sum of all Cash Movements In. |

|

Cash Out |

Sum of all Cash Movements Out. |

|

Cash Refunds |

Sum of AR Credit Memo’s where tender type is cash. |

|

Cash Refund Tickets |

Number of AR Credit Memo’s where tender type is cash. |

|

Credit Card Refunds |

Sum of AR Credit Memo’s where tender type is credit card. |

|

Credit Card Refund Tickets |

Number of AR Credit Memo’s where tender type is credit card. |

|

Calculated Cash On Hand |

Calculated: Opening Cash Balance + Cash Sales + Cash In – Cash Out - Cash Refunds |

|

Calculated Checks On Hand |

Calculated: Opening Check Balance + Check Sales |

|

Actual Cash On Hand |

Entered by user |

|

Actual Checks On Hand |

Entered by user |

|

Cash Over/(Short) |

Calculated: Calculated Cash On Hand – Actual Cash On Hand |

|

Checks Over/(Short) |

Calculated: Calculated Checks On Hand – Actual Checks On Hand |

|

Cash Deposit |

Calculated: Actual Cash On Hand – Closing Cash Balance |

|

Checks Deposit |

Calculated: Actual Checks On Hand – Closing Checks Balance |

|

Closing Cash Balance |

Updated by user; carry over to next day. |

|

Closing Checks Balance |

Updated by user; carry over to next day. |

Select Print to print out the report.

Reports

End of Day Report

The "End of Day Report" may also be run on an as needed basis. This report summarizes the opening balances, daily activity, and ending balances for a selected terminal by date / time.

Menu Path: Sales > Point of Sale > Reports > End of Day Report

List view:

Edit view:

End of Day Report Line – child tab

If any cash movement adjustments occurred, they would be displayed here.

End of Day Transaction – child tab - transaction(tickets) will be displayed

Cash In / Cash Out – child tab

Sales POS Report

The Sales POS Report provides the user with several filters to select from before executing the report itself. These parameters may be saved and used to re-run the report.

Menu Path: Sales > Point of Sale > Reports > Sales POS Report

Report parameter selection window:

Report result window:

Report Wizard:

In addition to having user assigned parameters when running this report, the report wizard allows you to configure the report output. Select the wand icon to open the wizard.

Report formats may be copied and saved under a different "format name" which would allow you to customize the copied format leaving the original format in tack. Report results may be displayed by the various saved formats.

Select the Copy Print Format button to create a new print format. It will initially be saved as the "existing format name – copy", but may be renamed utilizing the Customize Report function described below.

Payment Details Report

The Payment Details Report

Menu Path: Sales > Reports > Payment Details Report

Report parameter selection window:

Report result window:

Report Wizard:

In addition to having user assigned parameters when running this report, the report wizard allows you to configure the report output.

In this example, we will create a new print format by selecting the Copy Print Format button. This will allow us to modify the new format while leaving the original in tack.

The new print format will be appended with a "– Copy".

This format may now be modified using the Report Wizard without affecting the original print format. Select the "save" icon after making changes and then select the green check box to display the print format version.

Once changes are made to this copied format, the "name" of the print format and other changes may be updated using the "Customize Report" utility. Select the "Wrench & Screw Driver" icon in the gray toolbar to open the customize report utility.

Here you may update the print format name to associate the version to a user or department for example. In this example, we have updated the print format to "Payment Details – Sean’s Version". You may also assign a "Default" report version.

When the report is re-run, you may select which print format version you would like to see: